General FAQ for M+ Global Account

M+ Global户口常见问题

CUSTOM JAVASCRIPT / HTML

CUSTOM JAVASCRIPT / HTML

New Features!

Conditional Order (Stop Loss)

客制化订单Conditional order types

🔹Arrival Price Order

🔸Stop Loss Order

🔸Stop Loss Limit Order

🔺Take Profit Order

🔺Take Profit Limit Order

Trading & Account Information 交易账户信息

Trading & Account Information交易账户信息

How to Re-apply for a MY Stock Trading Account?

Re-apply for a MY Stock Trading Account

1. Click on the "Trade" tab and select "More".

2. Navigate to the "All Functions" page and click on "Trading Authority".

3. Click on the "Open" button

4. Select the account type, and click "Next"

5. Enter your personal details

6. Provide your taxation details

7. Review and accept the agreement

8. Sign the agreement

9. Make the payment of RM11 by clicking "Proceed to Payment" to go to the eGHL payment page, follow the instructions on the page, and then click on "Return to Malacca Securities S/B page" after a successful payment.

Deposit Instructions

Detailed steps for Depositing Funds:

1. Open the M+ Global App, and click “Deposit” on the “Trade” tab.

2. On the deposit page, select "Online FPX Deposit."

3. On the deposit information page, enter the deposit amount (1,000 ≤ the amount entered ≤ 30,000), and click “Confirm” if the deposit information is accurate.

4. Proceed to the eGHL payment page, log in to the bank account as instructed, confirm the payment information, and click “Return to Malacca Securities S/B page” after successful payment

5. Submit the deposit for review. If the deposit meets the automatic review conditions (transferred from the account with the same name), you can directly skip to the successful deposit page.

1. Open the M+ Global App, and click “Deposit” on the “Trade” tab.

Tips:

1. Only deposits and withdrawals in Malaysian Ringgit (MYR) are allowed, and they must be made from and to accounts opened with local banks in Malaysia.

2. The name of the account from which funds are deposited must match the name of the M+ Global account holder. Deposits from accounts held by other individuals or joint accounts are not allowed, except for relatives. Customers will be solely responsible for any refund costs incurred due to incorrect deposits.

3. Deposits will be processed and settled by banks and financial institutions on working days. Please keep in mind public holidays and festivities in Malaysia when making payment arrangements and ensure adequate time for processing.

4. M+ Global currently does not accept cash deposits made directly at bank counters, ATMs, or other channels in Malaysia.

1. Only deposits and withdrawals in Malaysian Ringgit (MYR) are allowed, and they must be made from and to accounts opened with local banks in Malaysia.

2. The name of the account from which funds are deposited must match the name of the M+ Global account holder. Deposits from accounts held by other individuals or joint accounts are not allowed, except for relatives. Customers will be solely responsible for any refund costs incurred due to incorrect deposits.

3. Deposits will be processed and settled by banks and financial institutions on working days. Please keep in mind public holidays and festivities in Malaysia when making payment arrangements and ensure adequate time for processing.

4. M+ Global currently does not accept cash deposits made directly at bank counters, ATMs, or other channels in Malaysia.

Deposit steps:

1. Ensure that your M+ Global account is opened with a local bank in Malaysia and has sufficient funds.

2. Log in to the M+ Global App, and proceed to deposit into your M+ Global securities account.

*Only deposits through Online FPX are currently accepted by M+ Global

3. Wait for review. Deposits that meet the automatic review conditions (transferred from an account with the same name) will be credited to the securities account within 5 minutes. For other deposits, a review will take place within 1-3 working days.

1. Ensure that your M+ Global account is opened with a local bank in Malaysia and has sufficient funds.

2. Log in to the M+ Global App, and proceed to deposit into your M+ Global securities account.

*Only deposits through Online FPX are currently accepted by M+ Global

3. Wait for review. Deposits that meet the automatic review conditions (transferred from an account with the same name) will be credited to the securities account within 5 minutes. For other deposits, a review will take place within 1-3 working days.

Deposit currency:

1. At the moment, only deposits in MYR are allowed.

2. Funds deposited into a M+ Global account can be converted into Hong Kong dollars or U.S. dollars for stock trading in the HK and US stock markets.

1. At the moment, only deposits in MYR are allowed.

Methods of deposit:

If you have an account opened with a local bank in Malaysia:

If you have an account opened with a local bank in Malaysia:

- Transfer Method: Online FPX

-

Steps to Transfer: Start deposit in the M+ Gobal APP

-

Estimated Transfer Time: 5 minutes

-

Service Fee: Free of charge

*Please note that the estimated transfer time provided by M+ Global is an estimation of the time required for the deposit to be credited into your account, and may be extended during non-trading hours.

*Please note that the estimated transfer time provided by M+ Global is an estimation of the time required for the deposit to be credited into your account, and may be extended during non-trading hours.

Withdrawal Instructions

Detailed steps of Withdrawal:

1. Where to start

Open the M+ Global App, click “Withdraw” on the “Trade” tab.

2. Enter Withdrawal Details

(1) “Original currency” shows the withdrawable cash balances in different currencies in the account;

(2) “Withdraw USD amount” shows the amount in original currency to be withdrawn;

(3) “Estimate amount received” shows the amount in MYR converted from the above amount to be withdrawn, i.e. the (estimated) amount in MYR to be actually received by your account;

(4) “Beneficiary Bank Name” shows the name of the bank with which your account is opened, and can be directly selected from drop-downs;

(5) “Beneficiary Account Number” shows your account number which needs to be entered by you;

(6) Click “Submit”, and then click “Confirm” in the pop-up window to confirm the information.

3. Enter your trading password

4. Submit for Review.

Your application for withdrawal will be approved or rejected within 1-3 working days. The specific time for the withdrawn amount to be paid into your account depends on the bank's processing progress.

1. Where to start

Tips:

1. Only withdrawals and deposits in MYR are allowed Only deposits from and withdrawals to accounts opened with local banks in Malaysia are allowed.

2. No amount withdrawn may be paid into accounts opened with virtual banks or with third-party payment platforms.

1. Only withdrawals and deposits in MYR are allowed Only deposits from and withdrawals to accounts opened with local banks in Malaysia are allowed.

2. No amount withdrawn may be paid into accounts opened with virtual banks or with third-party payment platforms.

Withdrawal Steps:

1. Ensure that your account is opened with a local bank in Malaysia.

2. Log in to the M+Global App, and apply for a withdrawal to your account.

3. Submit the application for review. Your application for withdrawal will be approved or rejected within 1-3 working days. The time taken for the withdrawn amount to be credited to your account depends on the bank’s processing progress.

1. Ensure that your account is opened with a local bank in Malaysia.

2. Log in to the M+Global App, and apply for a withdrawal to your account.

3. Submit the application for review. Your application for withdrawal will be approved or rejected within 1-3 working days. The time taken for the withdrawn amount to be credited to your account depends on the bank’s processing progress.

Withdrawal currency:

1. Only withdrawals in MYR are currently allowed.

2. All Hong Kong dollars and U.S. dollars generated from stock trading in the HK and US stock markets and to be withdrawn will be converted into MYR. The converted amount that a customer sees when it submits an application for withdrawal is for reference only. The actual amount received by the customer's account in MYR will be calculated at the prevailing exchange rate at the time the withdrawal request is approved. As a result, there may be a slight difference between the actual amount received by the customer and the converted amount shown at the time of submitting the withdrawal request.

1. Only withdrawals in MYR are currently allowed.

Methods of Withdrawal:

If you have an account opened with a local bank in Malaysia:

If you have an account opened with a local bank in Malaysia:

- Transfer Method: Bank transfer

-

Steps to Transfer: Apply for withdrawal in the M+ Global APP

-

Review Period: 1-3 working days

-

Estimated Transfer Time: Depending on the bank’s processing progress

-

Service Fee: Free of charge

*The review period is the estimated time by M+ Global for processing a withdrawal application, and may be extended during non-trading hours.

*The review period is the estimated time by M+ Global for processing a withdrawal application, and may be extended during non-trading hours.

Inter Transfer between M+ Global & M+ Online

Method of Inter Transfer:

Instructions for Inter Transfer:

M+ Global App currently only allows stock trading in the Hong Kong and US stock markets, while M+ Online App only allows stock trading in the Malaysian stock market. Inter transfer between two accounts under the same user's name is allowed.

1. If you do not have enough funds for stock trading in the US stock market, you can transfer the funds from your M+ Online account to your M+ Global account.

2. If you do not have enough funds for stock trading in the Malaysian stock market, you can transfer the funds from your M+ Global account to your M+ Online account.

M+ Global App currently only allows stock trading in the Hong Kong and US stock markets, while M+ Online App only allows stock trading in the Malaysian stock market. Inter transfer between two accounts under the same user's name is allowed.

1. If you do not have enough funds for stock trading in the US stock market, you can transfer the funds from your M+ Online account to your M+ Global account.

2. If you do not have enough funds for stock trading in the Malaysian stock market, you can transfer the funds from your M+ Global account to your M+ Online account.

*Note: The two accounts for Inter transfer must be held by the same person.

*Note: The two accounts for Inter transfer must be held by the same person.

When the transferred amount will be received

Generally, the transferred amount will be received by the payee account within 1-2 minutes after the application for transfer, for which a message prompt will be given. Please check your payee account to make sure the transferred amount is received.

Generally, the transferred amount will be received by the payee account within 1-2 minutes after the application for transfer, for which a message prompt will be given. Please check your payee account to make sure the transferred amount is received.

Service charge for Inter Transfer

Inter Transfer is free of service charge.

Inter Transfer is free of service charge.

How to Place Order on M+ Global

How to Place Order on M+ Global

Steps: Choose the stock you want (Under "Watchlist" tab, click on the "Search" icon)

1. Under the stock, select 'Buy'

2. Enter trading pin

3. Key in the price

4. Key in quantity

5. Please select 'Not Allow' under 'Fill Outside RTH'

Steps: Choose the stock you want (Under "Watchlist" tab, click on the "Search" icon)

*As this will ensure the execution price of your order is closer to the expected price, and avoid your order being separate.

*As this will ensure the execution price of your order is closer to the expected price, and avoid your order being separate.

6. Click 'Confirm' to submit your order

7. It shows "Order Filled," indicating that you have successfully purchased the stock. Scroll down to view the details of your order.

6. Click 'Confirm' to submit your order

Order Type:

Limit order: A limit order is a type of order placed by an investor to buy or sell a stock at a specific price or better. It sets a maximum or minimum price at which the investor is willing to buy or sell the stock. If the stock reaches the specified price, the trade is executed. If the stock doesn't reach the specified price, the order may remain open until the conditions are met or canceled.

Market order: A market order is a type of order placed by an investor to buy or sell a stock at the best available price in the market. It prioritizes execution speed over price and guarantees immediate execution. When a market order is placed, the investor is willing to accept the prevailing market price for the stock. The order is executed as soon as possible at the current market price.

Limit order: A limit order is a type of order placed by an investor to buy or sell a stock at a specific price or better. It sets a maximum or minimum price at which the investor is willing to buy or sell the stock. If the stock reaches the specified price, the trade is executed. If the stock doesn't reach the specified price, the order may remain open until the conditions are met or canceled.

Market order: A market order is a type of order placed by an investor to buy or sell a stock at the best available price in the market. It prioritizes execution speed over price and guarantees immediate execution. When a market order is placed, the investor is willing to accept the prevailing market price for the stock. The order is executed as soon as possible at the current market price.

*Note: Choose Limit Order for a specific price; or Market Order for immediate execution.

*Note: Choose Limit Order for a specific price; or Market Order for immediate execution.

Fill Outside RTH (Regular Trading Hours):

Allow: "Fill Outside RTH" allows the order to be executed outside of regular trading hours (RTH). It means that the order can be filled before or after the normal trading session, providing the opportunity to take advantage of price movements that occur outside the regular market hours.

Not allow: "Fill Outside RTH" does not permit the order to be executed outside of regular trading hours. In this case, the order will only be eligible for execution during the standard trading session and will not be filled outside of those hours, regardless of any price fluctuations that may occur outside of RTH.

Allow: "Fill Outside RTH" allows the order to be executed outside of regular trading hours (RTH). It means that the order can be filled before or after the normal trading session, providing the opportunity to take advantage of price movements that occur outside the regular market hours.

Not allow: "Fill Outside RTH" does not permit the order to be executed outside of regular trading hours. In this case, the order will only be eligible for execution during the standard trading session and will not be filled outside of those hours, regardless of any price fluctuations that may occur outside of RTH.

*Note: Choose "Not Allow" to ensure order consolidation and avoid price fluctuations during non-regular trading hours.

*Note: Choose "Not Allow" to ensure order consolidation and avoid price fluctuations during non-regular trading hours.

Rate & Benefits 费用

US / HK Brokerage Fees

US brokerage fees

- Base Rate: 0.25%

-

Minimum Brokerage: $4.88

-

Live Quotes: Free 1st month

HK brokerage fees

- Base Rate: 0.2%

-

Minimum Brokerage: HKD 25

-

Live Quotes: Free 1st month

Other Benefits:

- Angeline & Team Support

- Daily stock updates

-

Stop loss feature

-

Portfolio review

- Advisory Service (Do With You)

-

Market outlook

-

Systematic stock screening Strategy

-

and many more...

Margin Account 保证金账户

How to Open and Cancel a Margin Account

How to Open a Margin Account

1. Trade > Margin Upgrade

2. Trade > Click Assets > Open Margin

3. Read and accept Customer Declaration > Read and accept Risk Disclosure > submit your request

(Your request will be reviewed within 1-2 working days. Review results will be made known to you via private message, SMS and email)

1. Trade > Margin Upgrade

How to Close a Margin Account

Please contact customer service if you want to close a margin account.

Please contact customer service if you want to close a margin account.

Margin Trading

Margin Trading

What is Margin Trading?

Margin trading refers to a transaction in which you use the securities or assets in your account as collateral and pay the related interest and handling fees to borrow more funds from M+ Global for securities purchases.

Margin trading refers to a transaction in which you use the securities or assets in your account as collateral and pay the related interest and handling fees to borrow more funds from M+ Global for securities purchases.

How to Perform Margin Trading

1. If you are a new user, please choose a margin account when opening an account. If you already have an M+ Global account and want to open a margin account, you can upgrade your account to a margin account by checking out "how to open a margin account" for more details.

2. Margin trading: If there are insufficient funds at the time of stock purchase, margin trading will be used by default.

1. If you are a new user, please choose a margin account when opening an account. If you already have an M+ Global account and want to open a margin account, you can upgrade your account to a margin account by checking out "how to open a margin account" for more details.

2. Margin trading: If there are insufficient funds at the time of stock purchase, margin trading will be used by default.

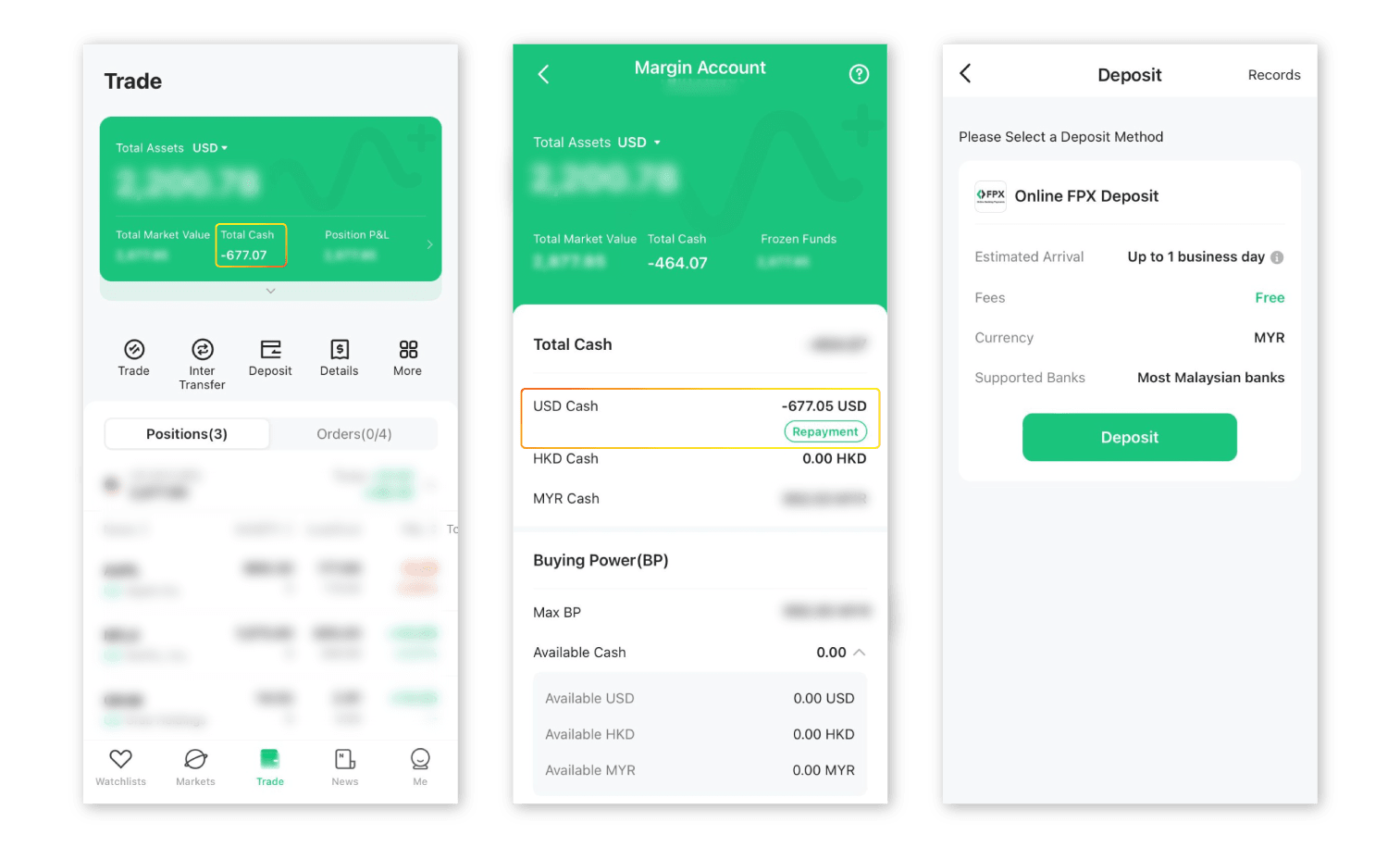

Guide to Handling Overtrading and Repayment in Margin Accounts:

Example:

Example:

• When overtrading occurs, the 'Total Cash' in the account will become negative.

• In such cases, refer to the highlighted box indicating the negative Total Cash.

• Proceed to the second photo, which shows the margin account page.

• Look for the "Repayment" section on the page.

• Pay the amount of money corresponding to the overtraded value by clicking on the "Repayment" option.

• After clicking, you will be directed to the deposit page to make the necessary deposit.

• When overtrading occurs, the 'Total Cash' in the account will become negative.

• In such cases, refer to the highlighted box indicating the negative Total Cash.

• Proceed to the second photo, which shows the margin account page.

• Look for the "Repayment" section on the page.

• Pay the amount of money corresponding to the overtraded value by clicking on the "Repayment" option.

• After clicking, you will be directed to the deposit page to make the necessary deposit.

Fees

Please refer to "How to view the Margin Ratio of a stock" for more details.

Please refer to "How to view the Margin Ratio of a stock" for more details.

How to view the Margin Ratio of a stock

How to Check the Stock's Margin Ratio

The financing margin ratio can be viewed in detail on the Individual Stock Details page-Financing Information page:

The financing margin ratio can be viewed in detail on the Individual Stock Details page-Financing Information page:

1. Select an individual stock

2. On the top right corner, click the little icon with "$"

3. Select "Marginable"

1. Select an individual stock

Margin Ratio

Initial Margin Ratio

Taking financing purchase as an example, if you want to buy a stock with a market value of USD$1 million when the initial margin rate of the stock is 100%, you will need USD$1 million (corresponding to 1 times leverage) to open a position. But if the initial margin rate is 80%, you will only need USD$800,000 to open a position and the remaining USD$200,000 will be the amount you borrow from M+ Global (equivalent to 1.25 times leverage).

Taking financing purchase as an example, if you want to buy a stock with a market value of USD$1 million when the initial margin rate of the stock is 100%, you will need USD$1 million (corresponding to 1 times leverage) to open a position. But if the initial margin rate is 80%, you will only need USD$800,000 to open a position and the remaining USD$200,000 will be the amount you borrow from M+ Global (equivalent to 1.25 times leverage).

Maintenance Margin Ratio

The maintenance margin ratio is the minimum margin ratio that you must maintain in your margin account if you want to continue holding a particular stock.

The maintenance margin ratio is the minimum margin ratio that you must maintain in your margin account if you want to continue holding a particular stock.

US Trading Hours

Pre-market and Post-market Trading Sessions

Pre-market:

- Eastern Standard Time: 4:00-9:30

-

Daylight Saving Time: 16:00-21:30 (KL Time)

-

Winter Time: 17:00-22:30 (KL Time)

Post-market:

- Eastern Standard Time: 16:00-20:00

-

Daylight Saving Time: 4:00-8:00 (KL Time)

-

Winter Time: 5:00-9:00 (KL Time)

Regular Trading Session

The regular trading session of US stocks is US Eastern Time (ET): Monday to Friday 9:30~16:00

US Daylight Saving Time (March-November): Kuala Lumpur Time 21:30~4:00

Winter time (November-March of the following year): Kuala Lumpur time 22:30~5:00

The regular trading session of US stocks is US Eastern Time (ET): Monday to Friday 9:30~16:00

US Daylight Saving Time (March-November): Kuala Lumpur Time 21:30~4:00

Winter time (November-March of the following year): Kuala Lumpur time 22:30~5:00

US Stock Market Holidays 2023:

According to The New York Stock Exchange (NYSE) regulations, the stock market is closed on designated holidays— New Year's Day, Martin Luther King Jr. Day, President's Day, Good Friday, Memorial Day, National Independence Day in June, Independence Day, Labor Day, Thanksgiving Day, and Christmas Festival. If the holiday falls on a Saturday, the exchange will be closed on Friday. If the holiday falls on a Sunday, the exchange will be closed on the following Monday. M+ Global will notify you of market closures in advance.

The 2023 U.S. stock market special holidays are as follows (Eastern Time):

• 29/05/2023 (Monday): Memorial Day /Closed

• 19/06/2023 (Monday): Juneteenth National Independence Day /Closed

• 04/07/2023 (Tuesday): Independence Day /Closed.

The market will be closed at 1:00 pm on 03/07 (3 hours in advance)

• 04/09/2023 (Monday): Labor Day /Closed

• 23/11/2023 (Thursday): Thanksgiving Day /Closed.

The market will be closed at 1:00 pm on 24/11 (3 hours in advance)

• 25/12/2023 (Monday): Christmas Day /Closed

According to The New York Stock Exchange (NYSE) regulations, the stock market is closed on designated holidays— New Year's Day, Martin Luther King Jr. Day, President's Day, Good Friday, Memorial Day, National Independence Day in June, Independence Day, Labor Day, Thanksgiving Day, and Christmas Festival. If the holiday falls on a Saturday, the exchange will be closed on Friday. If the holiday falls on a Sunday, the exchange will be closed on the following Monday. M+ Global will notify you of market closures in advance.

The 2023 U.S. stock market special holidays are as follows (Eastern Time):

• 29/05/2023 (Monday): Memorial Day /Closed

• 19/06/2023 (Monday): Juneteenth National Independence Day /Closed

• 04/07/2023 (Tuesday): Independence Day /Closed.

The market will be closed at 1:00 pm on 03/07 (3 hours in advance)

• 04/09/2023 (Monday): Labor Day /Closed

• 23/11/2023 (Thursday): Thanksgiving Day /Closed.

The market will be closed at 1:00 pm on 24/11 (3 hours in advance)

• 25/12/2023 (Monday): Christmas Day /Closed

HK Trading Hours

Besides public holidays and market closures due to bad weather, the Hong Kong stock market generally trades from Monday to Friday, and the trading hours are as follows:

- Pre-opening session: 9:00 am-9:30 am

-

Morning Session: 9:30 am-12:00 nn

-

Closing: 12:00 nn-1:00 pm

-

Afternoon Session: 1:00 pm-4:00 pm

-

Closing auction session: Start at 4:00pm, random closing between 4:08pm-4:10pm

*Half-day trading: Christmas, New Year and Lunar New Year's Eve

*Half-day trading: Christmas, New Year and Lunar New Year's Eve

Trading Rules for Each Trading Session

Pre-opening session

-

Order entry session 9:00-9:15:

You can submit, modify, and cancel at-auction orders and at-auction limit orders. -

No-cancellation session 9:15 – 9:20:

You can submit at-auction orders and at-auction limit orders but not modify and cancel orders. -

Random Matching Session 9:20-9:22 (Order matching will start randomly at 9:20-9:22 according to the final Indicative Equilibrium Price):

Matching orders submitted during the auction period. -

Blocking Session, end of random order matching 9:30:

At-auction order: The pending order will be cancelled by the system.

At-auction limit order: If the input price range of the unfinished order does not deviate from the original order price by nine times or more, it will be converted into a limit order and automatically transferred to the continuous trading session

Continous Trading Session

(1) The continuous trading hours of the securities market are from 9:30 am to 12:00 noon and 1:00 pm to 4:00 pm on each trading day. During the continuous trading session, the trading system will match orders input into the system in price and time priority.

(2) During the continuous trading session, the order price input into the trading system (i) must not deviate nine times or more from the nominal price, if available, or is one-ninth or less of that price and (ii) must follow the quotation rules unless the restriction is waived. In addition, the maximum order size is 3,000 board lots.

Note: Order amendment is not allowed during the noon market break, and order cancellation is only allowed between 12:30-13:00.

Closing Auction Session

-

Closing Auction Session 16:00-16:01:

Calculate and publish the reference price. Orders cannot be submitted. -

Order Input Session 16:01-16:06:

At-auction orders and at-auction limit orders can be submitted, modified, and cancelled. The price limit of at-auction limit orders shall not exceed ±5% of the reference price. -

No-Cancellation Session 16:06-16:08:

At-auction orders and at-auction limit orders can be submitted but cannot be cancelled or modified. The input price of an at-auction limit order must be between the lowest selling price and the highest buying price. -

Random Closing Session 16:08-16:10:

During the random closing session, at-auction orders and at-auction limit orders can still be submitted but cannot be cancelled or changed. The input price of auction limit orders must be between the lowest selling price and the highest buying price.